arizona real estate taxes

672022 2nd Installment Due. We created this site to help you to.

Should Turning 65 Exempt You From Property Taxes This Measure Would

Searching Up-To-Date Real Estate Records By County Just Got Easier.

. The total amount that will be billed in property taxes. View all options for payment of property taxes. Phoenix AZIdentity theft occurs year-round but the Arizona Department of Revenue ADOR advises taxpayers to be on heightened alert during tax season.

301 West Jefferson Street Phoenix Arizona 85003 Main Line. Interest on delinquent property tax is set by Arizona law at 16 percent simple and. AZTaxesgov allows electronic filing and payment of Transaction Privilege Tax TPT use taxes and withholding taxes.

Taxation of real property must. The local government receives approximately 40 of school. Although they are limited property tax exemption programs do exist in Arizona and might be the best option for you or a senior loved one in the event the property owner is a widowwidower or.

Ad Find property records tax records assets values and more. Discover public property records and information on land house and tax online. The median property tax in Arizona is 135600 per year for a home worth the median value of 18770000.

1st Installment Due. 972022 Last day to pay to avoid Tax Sale. Property taxes in Arizona are paid in two semi-annual.

Only 48 of school funding in Arizona comes from the state according to data from the US. Search the tax Codes and Rates for your area. By the end of September 2022 Pima County will mail approximately 455000 property tax bills for the various property taxing jurisdictions within the County.

1 be equal and uniform 2 be based on present market value 3 have a single appraised value and 4 be deemed taxable unless specially exempted. Counties in Arizona collect an average of 072 of a propertys assesed fair. Ad Unsure Of The Value Of Your Property.

The typical Arizona homeowner pays just 1578 in property taxes annually saving them 1000 in comparison to the national average. View the history of Land Parcel splits. Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the taxpayer.

Reduce property taxes for yourself or residential commercial businesses for commissions. An amount determined by the Assessors office and is used in the calculation of the tax bill of a. Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the.

Second half taxes are due Wednesday March 1 2023 and delinquent after Monday May 1 2023. Find All The Record Information You Need Here. Ad Reduce property taxes 4 residential retail businesses - profitable side business hustle.

Property Taxes For In Arizona Everything You Need To Know Kake

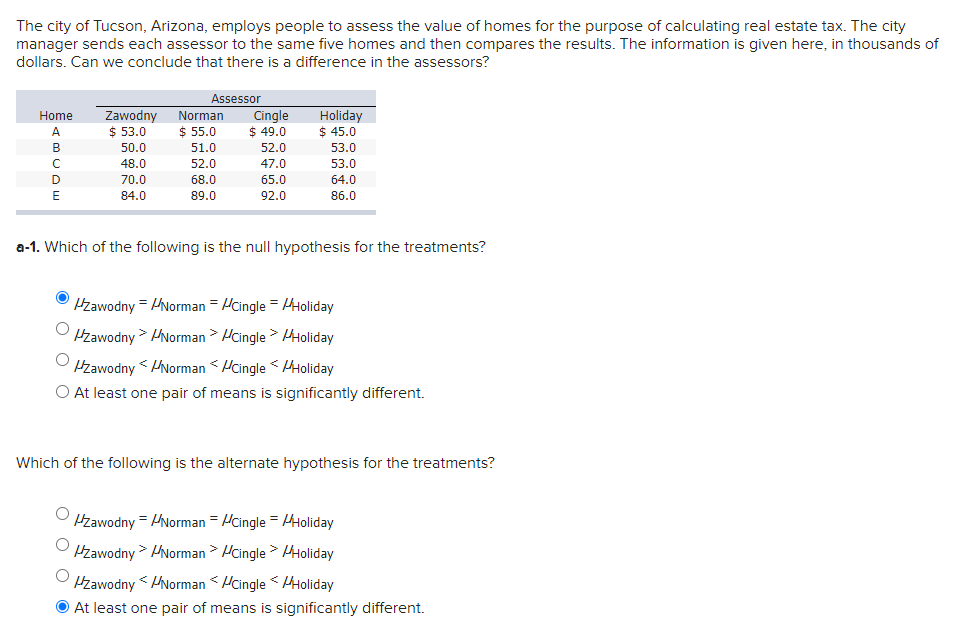

Solved The City Of Tucson Arizona Employs People To Assess Chegg Com

Property Tax Calculator Smartasset

Myths About Estate Planning In Arizona Law

The Lowest Property Taxes In Arizona Savingadvice Com Blog

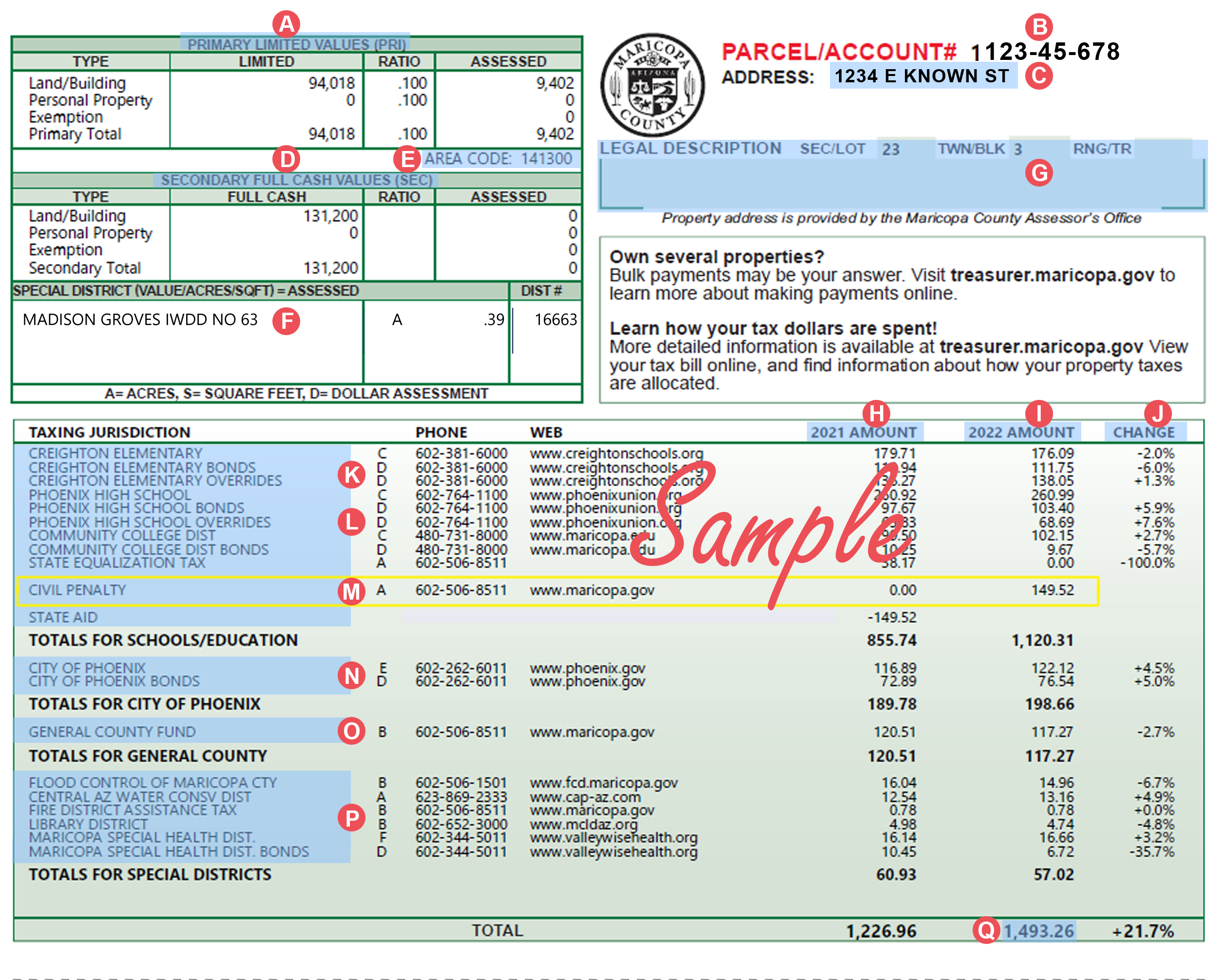

Maricopa County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Vacation Rental Taxes Aren T Being Paid Cities Az Taking Action

Village Land Shoppe Flagstaff Property Taxes Coconino County Taxes

Cost Of Living Value Sun City Arizona The Original Fun City

Property Tax Calculator Smartasset

Initiative Drive Would Exempt Arizona Seniors From Property Taxes On Homes

Applying For A Property Tax Exemption In Arizona Without A 501 C 3 Letter Provident Lawyers

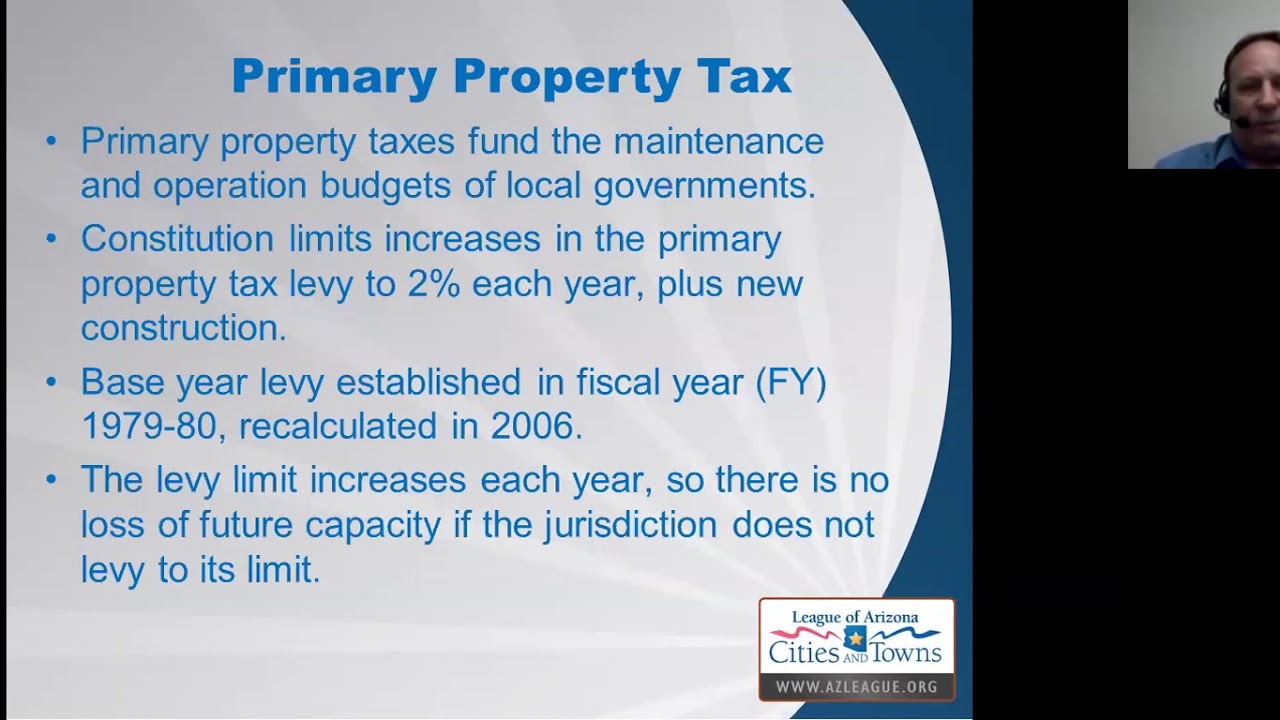

Property Tax In Arizona Youtube

Property Taxes In Arizona How Are They Assessed And When Are They Paid Homes For Sale Real Estate In Scottsdale Az Az Golf Homes

You Could Be Overpaying Property Taxes

Arizona Business Costs Win Over California Your Trusted Commercial Real Estate Advisor